- Home

- Products

FHIR Data Exchange

Ezovion FHIR engine enables health data exchange between healthcare stakeholders.

Digital Healthcare Platform

Integrated healthcare ecosystem for patient-centric healthcare delivery.

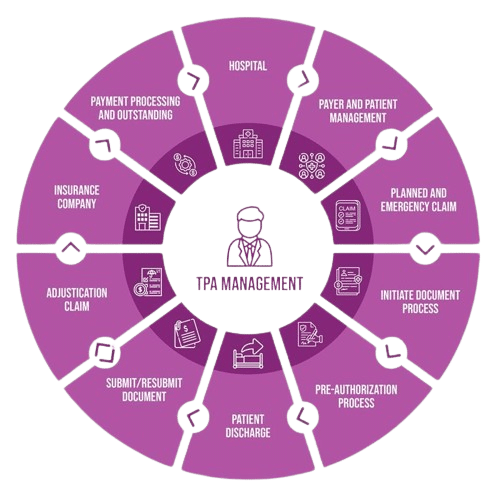

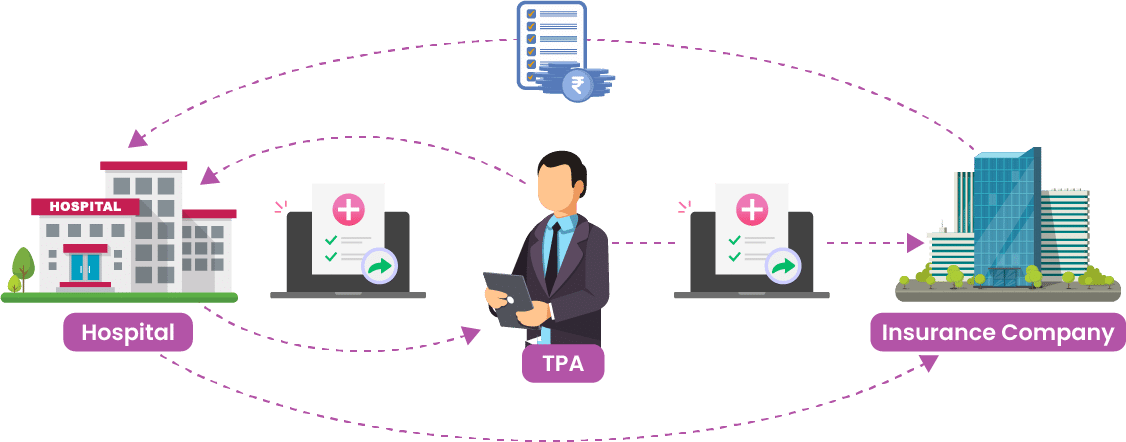

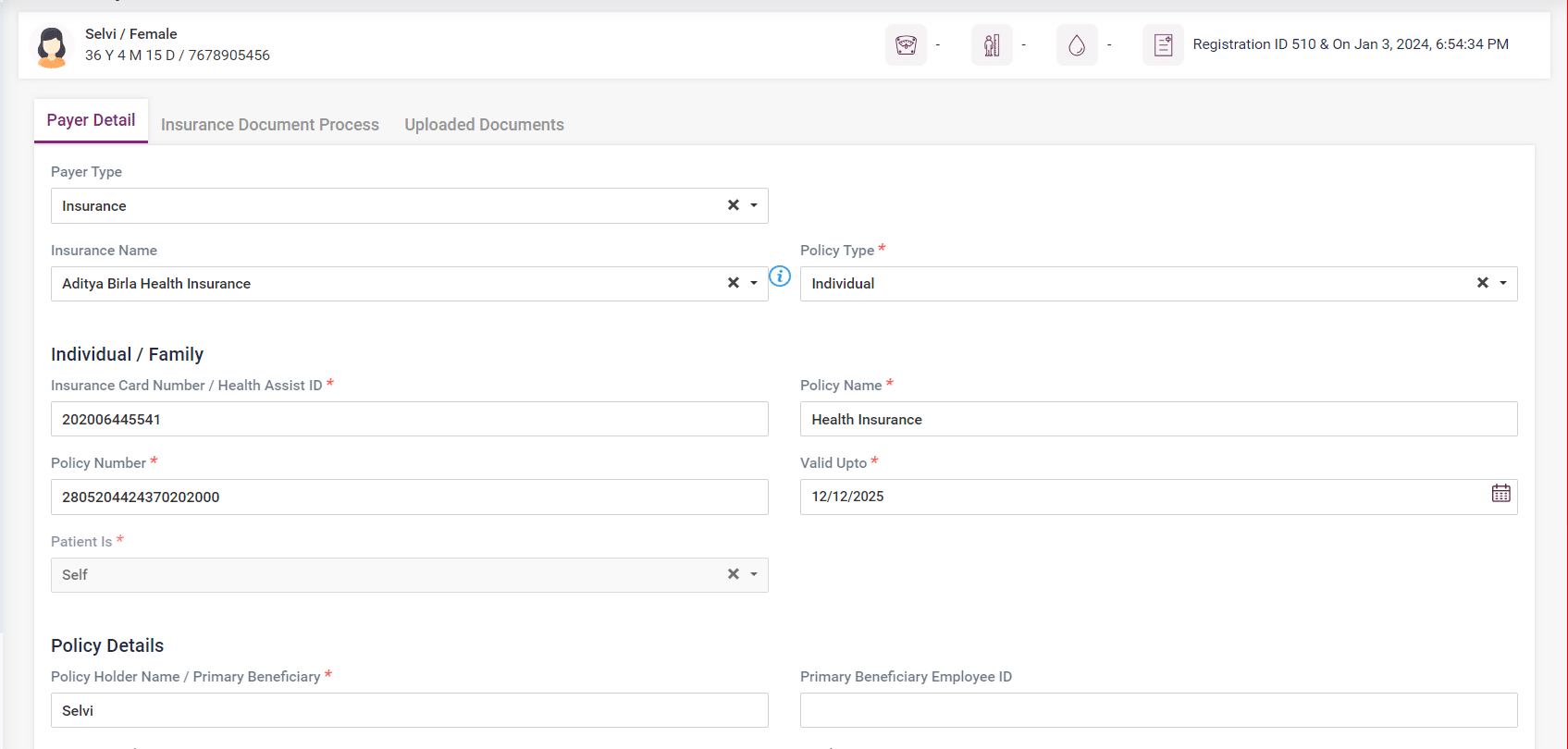

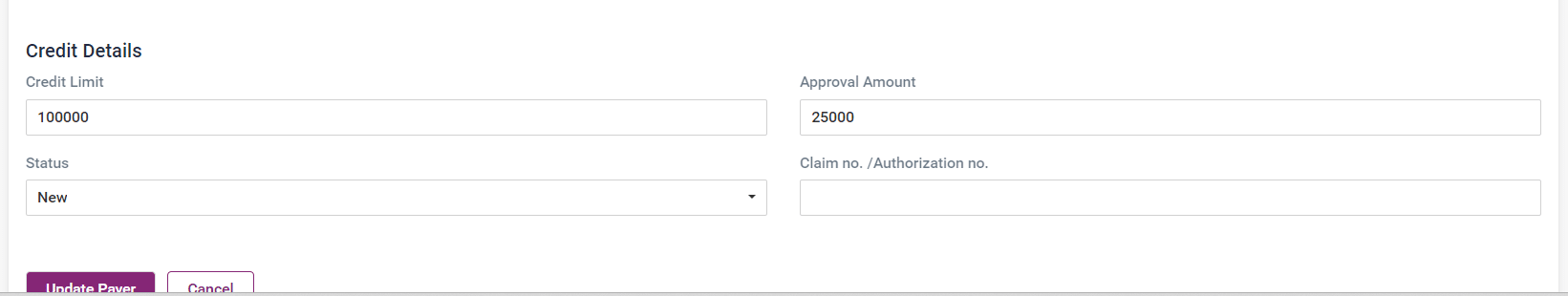

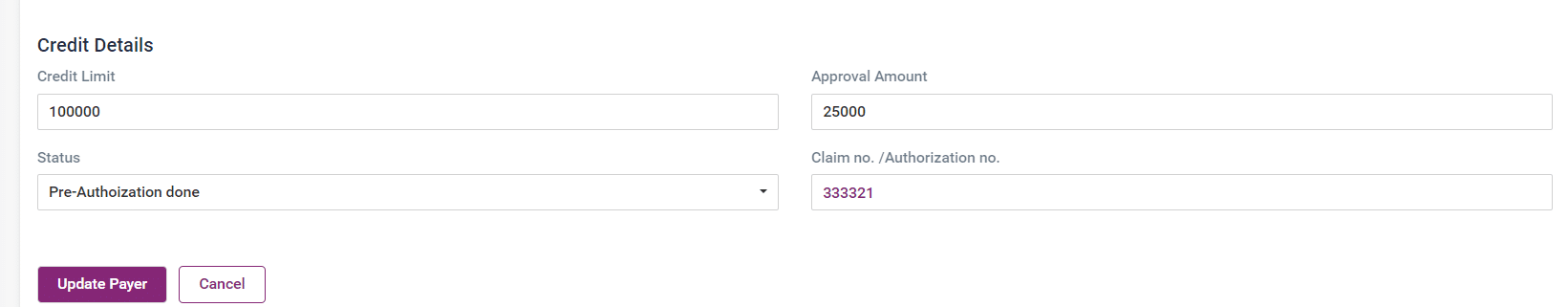

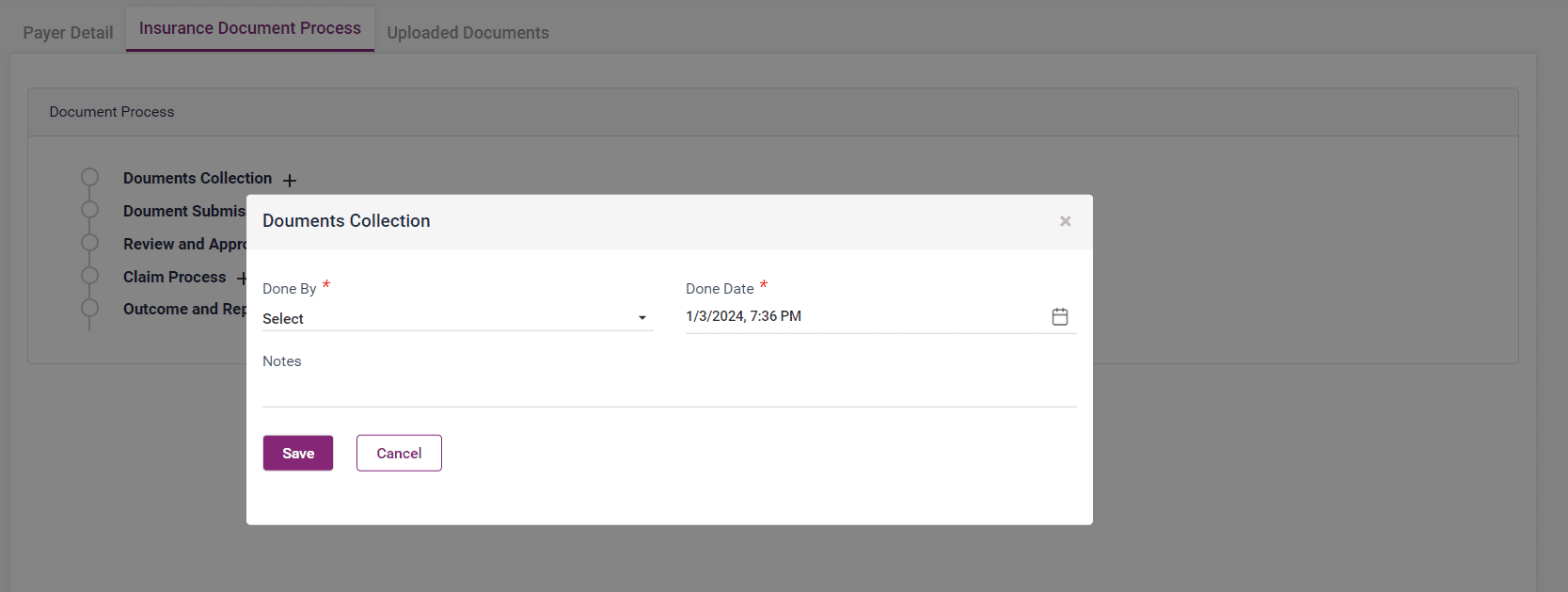

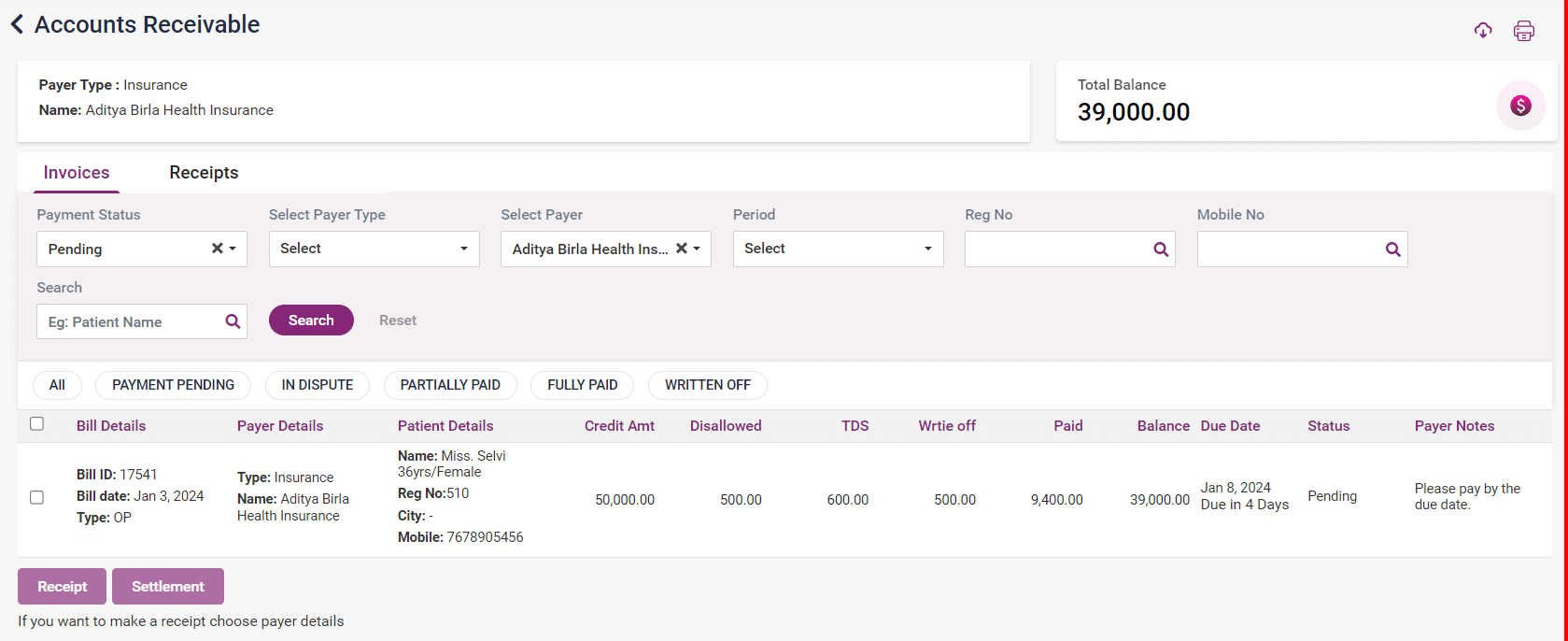

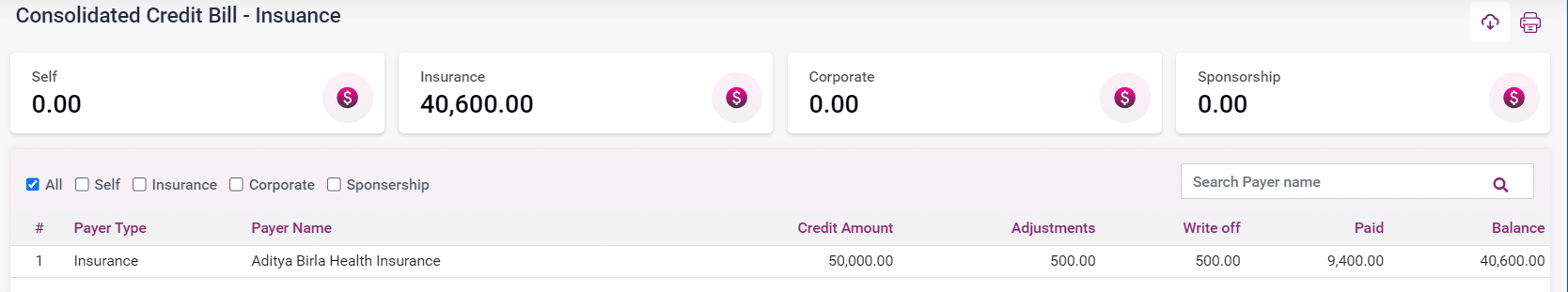

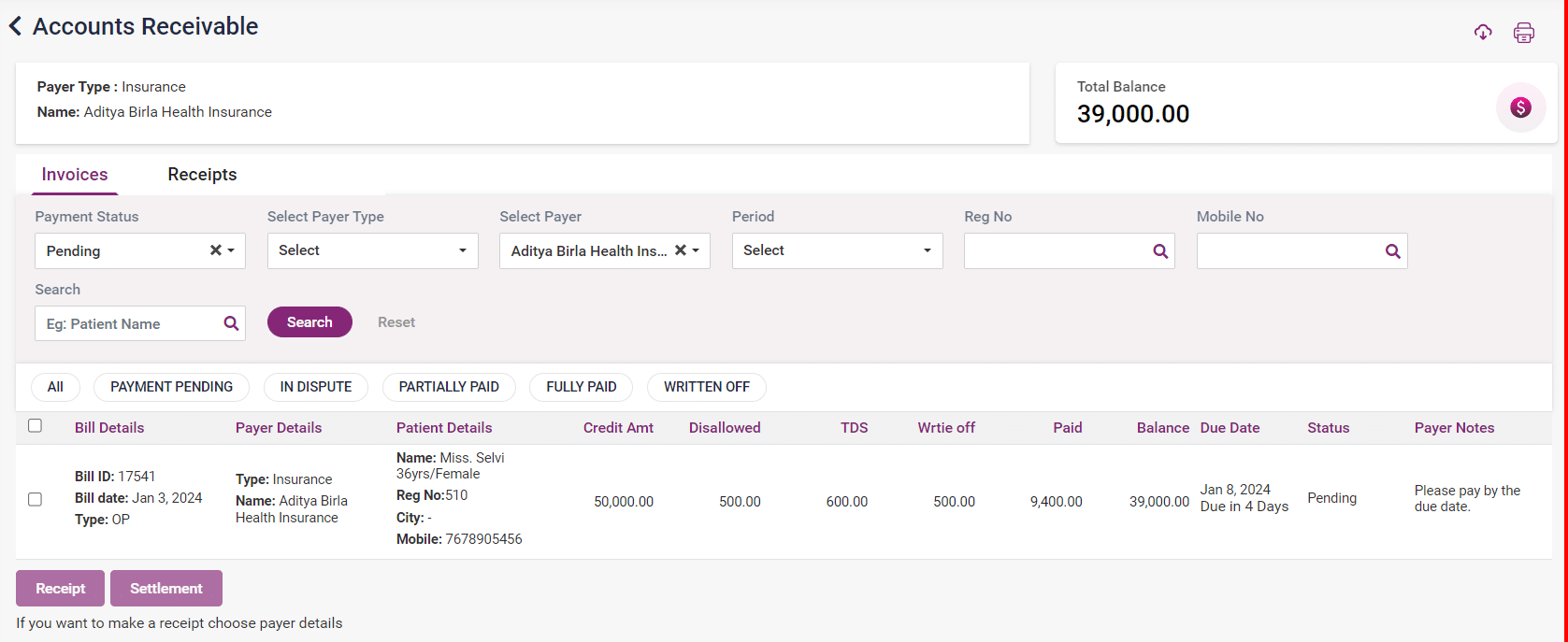

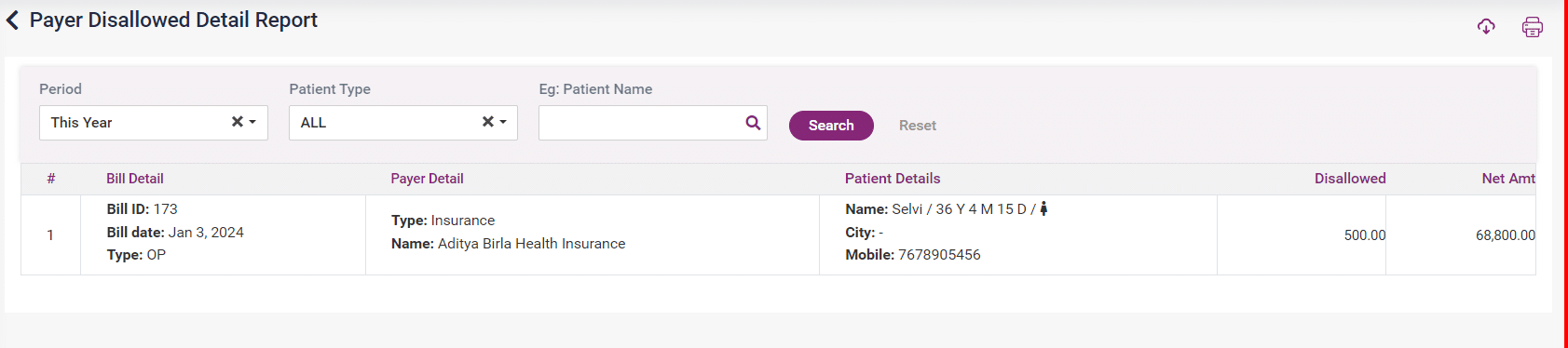

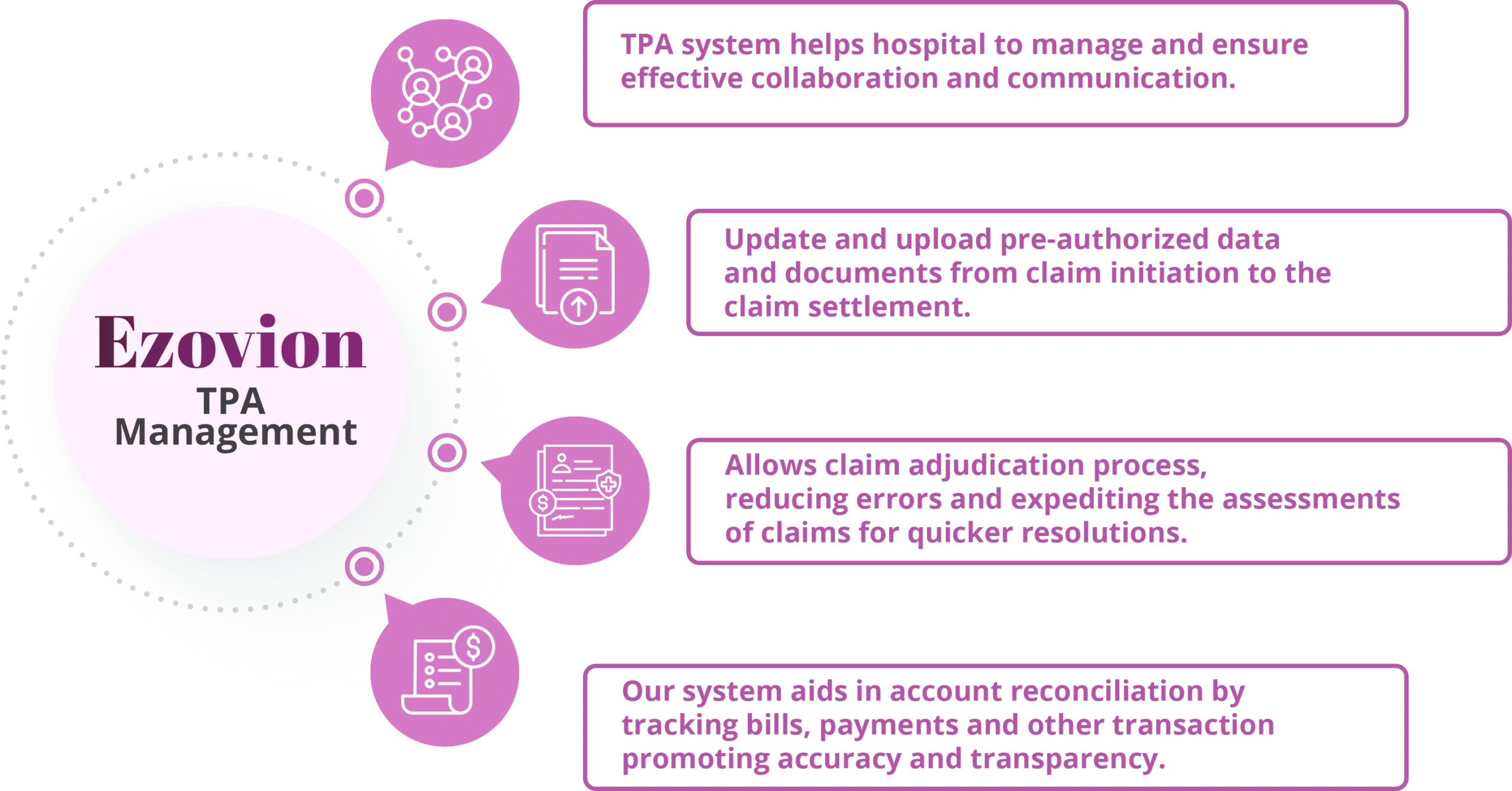

Revenue Cycle Management

Accelerate claim processing for faster account receivables.

- Services

- About Us